Note: This is a Kaplan CPA Review Question

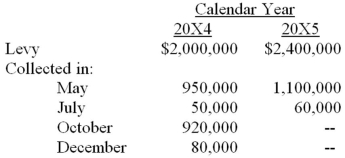

Pine City's year end is June 30. Pine levies property taxes in January of each year for the calendar year. One-half of the levy is due in May and one-half is due in October. Property tax revenue is budgeted for the period in which payment is due. The following information pertains to Pine's property taxes for the period from July 1, 20X4, to June 30, 20X5:

The $40,000 balance due for the May 20X5 installments was expected to be collected in August 20X5. What amount should Pine recognize for property tax revenue for the year ended June 30, 20X5?

Definitions:

Economic Term

A concept or terminology used within the field of economics to describe processes, theories, or phenomena related to how goods and services are produced, distributed, and consumed.

Opportunity Cost

Giving up potential improvements from various alternatives by choosing one option.

Scarcity

Scarcity refers to the fundamental economic problem of having seemingly unlimited human wants in a world of limited resources, leading to the necessity of allocation decisions.

Production

The process of combining various inputs to make goods or services for consumption.

Q1: Proxy statements are:<br>A) filed by an entity

Q14: ASC 270 uses which view of interim

Q15: Private Not-For-Profit (NFP) Entities.<br>Select from this list

Q23: Flyer Corporation holds 90 percent of Kite

Q31: Bill, Page, Larry, and Scott have decided

Q44: Catalyst Corporation acquired 90 percent of Trigger

Q44: On January 2, 20X8, Johnson Company acquired

Q49: Winner Corporation acquired 80 percent of the

Q53: On January 1, 2008, Pace Company acquired

Q79: On January 1, 20X1, Washington City received