Note: This is a Kaplan CPA Review Question

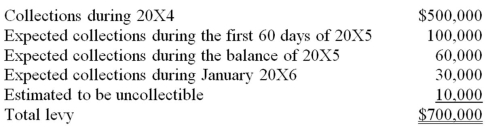

The following information pertains to property taxes levied by Oak City for 20X4:

What amount should Oak report for 20X4 net property tax revenues?

Definitions:

Net Income

The total profit of a company after all expenses, taxes, and costs have been deducted from total revenue.

Total Liabilities

The sum of all financial obligations a company owes to outside parties, including loans, accounts payable, and any other debts.

IFRS

International Financial Reporting Standards, which are global accounting standards for preparing financial statements, making it easier to compare entities internationally.

Current Liability

An obligation that a company is required to pay off within the current fiscal year or operating cycle, essentially a rephrased definition of current liabilities.

Q3: Which of the studies A, B, C,

Q8: Which of the following aspects of a

Q8: The first sentence serves a variety of

Q11: Which of the following represents an example

Q11: Which quantitative research design is considered the

Q21: For the first quarter of 20X8, Vinyl

Q22: All of the following are true statements

Q47: The following information was obtained from the

Q78: A private, not-for-profit hospital received a contribution

Q112: Investment income for not-for-profit entities may include:<br>I.