Note: This is a Kaplan CPA Review Question

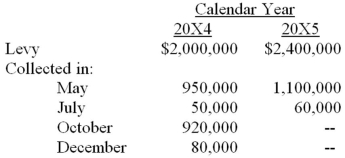

Pine City's year end is June 30. Pine levies property taxes in January of each year for the calendar year. One-half of the levy is due in May and one-half is due in October. Property tax revenue is budgeted for the period in which payment is due. The following information pertains to Pine's property taxes for the period from July 1, 20X4, to June 30, 20X5:

The $40,000 balance due for the May 20X5 installments was expected to be collected in August 20X5. What amount should Pine recognize for property tax revenue for the year ended June 30, 20X5?

Definitions:

Pulmonary Veins

Blood vessels that carry oxygenated blood from the lungs back to the left atrium of the heart.

Fibrous Pericardium

The outer layer of the heart's pericardium, consisting of tough connective tissue that protects the heart and anchors it within the chest.

Epicardium

The outermost layer of the heart wall, consisting of an inner visceral layer of the pericardium that protects and lubricates the heart.

Venous Cavity

A space within the body where deoxygenated blood is collected from the venous system before being returned to the heart.

Q6: In 20X6 and 20X7, each of Putney

Q8: Which of the following is an example

Q13: Why is reviewing the literature an important

Q20: Michigan-based Leo Corporation acquired 100 percent of

Q28: Catalyst Corporation acquired 90 percent of Trigger

Q35: Which of the following observations concerning interfund

Q43: If the U.S. dollar is the currency

Q49: Winner Corporation acquired 80 percent of the

Q59: Which of the following items should not

Q70: The transactions described in the following questions