Note: This is a Kaplan CPA Review Question

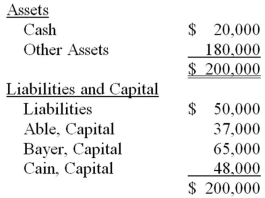

The following balance sheet is for the partnership of Able, Bayer, and Cain which shares profits and losses in the ratio of 4:4:2, respectively.

The original partnership was dissolved when its assets, liabilities, and capital were as shown on the above balance sheet and liquidated by selling assets in installments. The first sale of noncash assets having a book value of $90,000 realized $50,000, and all cash available after settlement with creditors was distributed. How much cash should the respective partners receive (to the nearest dollar) ?

Definitions:

Merchandise

Goods that are bought and sold by a business in the regular course of its operation.

Adjusted Trial Balance

A statement prepared after adjusting entries are made, used to verify the balance of debits and credits before preparing financial statements.

End-of-period Spreadsheet

A tool used in accounting to gather all the financial data and adjustments needed to prepare financial statements at the end of an accounting period.

Adjusted Trial Balance

A listing of all company accounts that will appear in the financial statements after adjustments have been made for journal entries.

Q1: On January 2, 20X8, Johnson Company acquired

Q5: On December 5, 20X8, Texas based Imperial

Q7: What criteria below would be least important

Q12: Denver Corporation owns 25 percent of the

Q12: Note: This is a Kaplan CPA Review

Q18: Granite Company issued $200,000 of 10 percent

Q41: Under the Bankruptcy Code, an insolvent corporation

Q52: Note: This is a Kaplan CPA Review

Q55: Note: This is a Kaplan CPA Review

Q62: On December 1, 20X8, Hedge Company entered