Note: This is a Kaplan CPA Review Question

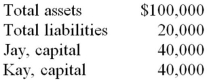

Jay & Kay partnership's balance sheet at December 31, 20X1, reported the following:

On January 2, 20X2, Jay and Kay dissolved their partnership and transferred all assets and liabilities to a newly-formed corporation. At the date of incorporation, the fair value of the net assets was $12,000 more than the carrying amount on the partnership's books, of which $7,000 was assigned to tangible assets and $5,000 was assigned to goodwill. Jay and Kay were each issued 5,000 shares of the corporation's $1 par value common stock. Immediately following incorporation, additional paid-in capital in excess of par should be credited for

Definitions:

Behaviour

Refers to the actions or reactions of an object or organism, usually in relation to the environment or surrounding.

Positive Norms

Expected behaviors within a group that contribute to a positive and constructive environment.

Team Cohesiveness

The extent to which team members are attracted to the team and motivated to remain in it, characterized by strong bonds, commitment to common goals, and mutual support.

Leaders

Individuals who influence, guide, or direct others within an organization or group towards achieving a collective goal.

Q4: Under a composition agreement,<br>A) creditors agree to

Q7: Simon Company has two foreign subsidiaries. One

Q7: What criteria below would be least important

Q16: Assume that a private university collects tuition

Q30: Moon Corporation issued $300,000 par value 10-year

Q39: Heavy Company sold metal scrap to a

Q61: Frahm Company incurred a first quarter operating

Q63: At any time, the remaining appropriating authority

Q65: In a statement of revenues, expenditures, and

Q71: A donor agrees to contribute $5,000 per