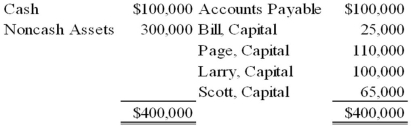

Bill, Page, Larry, and Scott have decided to terminate their partnership. The partnership's balance sheet at the time they decide to wind up is as follows:  During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 4:2:1:3.

During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 4:2:1:3.

Based on the preceding information, what amount will be paid out to Scott upon liquidation of the partnership?

Definitions:

Employee Database

A system that stores and manages data about an organization's employees.

General Manager

A high-ranking executive who has overall responsibility for managing both the revenue and cost elements of a company's income statement, known as the profit & loss (P&L) responsibility.

Job Specifications

A detailed description of the qualifications, skills, and experience required for a specific job, including duties and responsibilities.

Educational Requirements

The specified level of education or training necessary for an occupation or for admission to an institution or program.

Q1: To change a mixed methods research study

Q1: Which of the following is typically discussed

Q3: In the computation of a partner's Loss

Q5: On January 1, 20X8, Transport Corporation acquired

Q10: Quantum Company imports goods from different countries.

Q12: Suppose you are reading a report about

Q16: ABC, a holder of a $400,000 XYZ

Q30: A loss on the constructive retirement of

Q35: Mint Corporation has several transactions with foreign

Q77: On July 1, 20X8, Cleveland established a