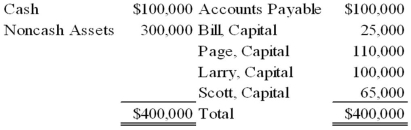

Bill, Page, Larry, and Scott have decided to terminate their partnership. The partnership's balance sheet at the time they decide to wind up is as follows:  During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 3:2:1:4.

During the winding up of the partnership, the other assets are sold for $150,000 and the accounts payable are paid. Page and Larry are personally solvent, but Bill and Scott are personally insolvent. The partners share profits and losses in the ratio of 3:2:1:4.

Based on the preceding information, what amount will be paid out to Bill upon liquidation of the partnership?

Definitions:

Formulate Plan

The act of creating a detailed proposal for achieving specific objectives or solving particular problems.

Closing Section

The final part of a document, presentation, or communication, summarizing key points and often providing recommendations or calls to action.

Thank-You Note

A written expression of gratitude, often sent after receiving a gift or favor.

Abbreviations

Shortened forms of words or phrases, used to save space or time, such as "ASAP" for "as soon as possible."

Q14: Which of the following items are likely

Q17: Suppose the direct foreign exchange rates in

Q28: All assets and liabilities are transferred to

Q35: In which of the following ways can

Q36: Lloyd Corporation reports the following information for

Q40: On July 1, 20X8, Fair Logic Corporation

Q49: All assets and liabilities are transferred to

Q60: Forge Company, a calendar-year entity, had 6,000

Q72: Accounting processes differ between a for-profit entity

Q76: An internal service fund had the following