Note: This is a Kaplan CPA Review Question

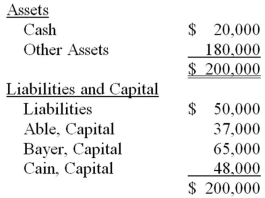

The following balance sheet is for the partnership of Able, Bayer, and Cain which shares profits and losses in the ratio of 4:4:2, respectively.

The original partnership was dissolved when its assets, liabilities, and capital were as shown on the above balance sheet and liquidated by selling assets in installments. The first sale of noncash assets having a book value of $90,000 realized $50,000, and all cash available after settlement with creditors was distributed. How much cash should the respective partners receive (to the nearest dollar) ?

Definitions:

Genetic Drift

A mechanism of evolution that results in random changes in the frequency of alleles (gene variants) in a population over time due to chance events.

Geographic Isolation

Refers to the separation of populations by physical barriers, such as mountains or rivers, leading to genetic divergence and speciation.

Cultural Beliefs

The shared ideas, customs, and social behavior of particular people or societies that influence their worldviews and ways of life.

Johann Blumenbach

A German physician, naturalist, physiologist, and anthropologist, known for his classification of human races.

Q1: Which of the following statement is true

Q14: Taste Bits Inc. purchased chocolates from Switzerland

Q16: Wakefield Company uses a perpetual inventory system.

Q22: Granite Company issued $200,000 of 10 percent

Q23: Note: This is a Kaplan CPA Review

Q31: When one company purchases the debt of

Q35: Which of the following acts requires that

Q36: Granite Company issued $200,000 of 10 percent

Q55: All assets and liabilities are transferred to

Q74: Gotham City acquires $25,000 of inventory on