Note: This is a Kaplan CPA Review Question

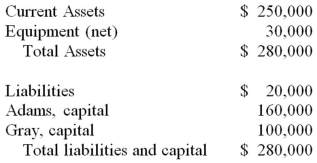

The condensed balance sheet of Adams & Gray, a partnership, at December 31, 20X1, follows:

On December 31, 20X1, the fair values of the assets and liabilities were appraised at $240,000 and $20,000, respectively, by an independent appraiser. On January 2, 20X2, the partnership was incorporated and 1,000 shares of $5 par value common stock were issued. Immediately after the incorporation, what amount should the new corporation report as additional paid-in capital?

Definitions:

Q5: Which of the following best describes the

Q6: Orville Company recently petitioned for bankruptcy and

Q12: Which monthly report shows the results of

Q15: Note: This is a Kaplan CPA Review

Q19: The general fund of the City of

Q23: Trevor Company discloses supplementary operating segment information

Q32: Senior Corporation acquired 80 percent of Junior

Q38: Hunter Corporation holds 80 percent of the

Q64: A voluntary health and welfare organization received

Q97: Private Not-For-Profit (NFP) Entities.<br>Select from this list