Note: This is a Kaplan CPA Review Question

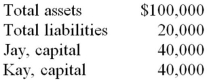

Jay & Kay partnership's balance sheet at December 31, 20X1, reported the following:

On January 2, 20X2, Jay and Kay dissolved their partnership and transferred all assets and liabilities to a newly-formed corporation. At the date of incorporation, the fair value of the net assets was $12,000 more than the carrying amount on the partnership's books, of which $7,000 was assigned to tangible assets and $5,000 was assigned to goodwill. Jay and Kay were each issued 5,000 shares of the corporation's $1 par value common stock. Immediately following incorporation, additional paid-in capital in excess of par should be credited for

Definitions:

Social Responsibility

The ethical framework suggesting that entities, whether individuals or organizations, are obligated to act for the benefit of society at large.

Discretionary Responsibilities

Tasks or responsibilities assigned to employees that require them to use their judgment and make decisions within their area of authority.

Biodegradable Packaging

This is packaging made from materials that can break down and decompose naturally in the environment, minimizing pollution.

Corporate Social Responsibility (CSR)

A strategy in business that promotes sustainable development through the provision of economic, social, and environmental advantages for every stakeholder involved.

Q1: Researchers choose to use a general thematic

Q4: Under a composition agreement,<br>A) creditors agree to

Q5: A subsidiary issues bonds. The parent can

Q6: All assets and liabilities are transferred to

Q9: Conduct extensive fieldwork. Which qualitative research design

Q31: The fair market value of a near-month

Q33: Winner Corporation acquired 80 percent of the

Q37: The British subsidiary of a U.S. company

Q51: The management approach to the definition of

Q80: A not-for-profit organization received a donation temporarily