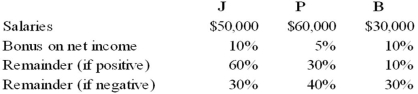

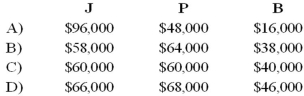

The JPB partnership reported net income of $160,000 for the year ended December 31, 20X8. According to the partnership agreement, partnership profits and losses are to be distributed as follows:  How should partnership net income for 20X8 be allocated to J, P, and B?

How should partnership net income for 20X8 be allocated to J, P, and B?

Definitions:

Infrastructure

The interconnected network of large-scale capital goods (such as roads, sewers, electrical grids, railways, ports, and the Internet) needed to operate a technologically advanced economy.

Entrepreneurial Class

A segment of society that is involved in or has the capacity to undertake new business ventures and innovate, often leading to job creation and economic development.

Capital Investment

Funds invested in a business with the intent of enhancing its capacity or operations, often involving expenditures on equipment or infrastructure.

Capital Flight

The large-scale exodus of financial assets and capital from a country due to economic or political instability, leading to a decrease in investment and economic growth.

Q4: Note: This is a Kaplan CPA Review

Q14: Master Corporation owns 85 percent of Servant

Q19: The Securities and Exchange Commission is responsible

Q28: Note: This is a Kaplan CPA Review

Q29: On December 1, 20X8, Secure Company bought

Q30: Riviera Township reported the following data for

Q35: Trimester Corporation's revenue for the year ended

Q38: In a university, class cancellation refunds of

Q59: Which of the following items should not

Q70: The transactions described in the following questions