Note: This is a Kaplan CPA Review Question

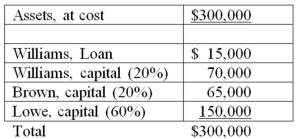

On June 30, the balance sheet for the partnership of Williams, Brown and Lowe, together with their respective profit and loss ratios, was as follows:

Williams has decided to retire from the partnership and by mutual agreement the assets are to be adjusted to their fair value of $360,000 at June 30. It was agreed that the partnership would pay Williams $102,000 cash for his partnership interest exclusive of his loan which is to be repaid in full. No goodwill is to be recorded in this transaction. After William's retirement, and before the loan is repaid, what are the capital account balances of Brown and Lowe, respectively?

Definitions:

Light Adaptation

The process by which the eye adjusts to bright light conditions after being in darker settings.

Squint

A condition where the eyes do not properly align with each other when looking at an object, leading to uncoordinated eye movements.

Opponent Process Theory

A theory of color vision and visual processing that proposes color perception is controlled by the activity of two opponent systems: a blue-yellow mechanism and a red-green mechanism.

Afterimage

A visual phenomenon where an image continues to appear in one's vision after the exposure to the original image has ended.

Q3: The APB partnership agreement specifies that partnership

Q3: Company A owns 85 percent of Company

Q6: During the fiscal year ended June 30,

Q19: The Securities and Exchange Commission is responsible

Q22: Partners Dennis and Lilly have decided to

Q24: The preparation of which of the following

Q32: Dividends of a foreign subsidiary are translated

Q38: Iona Corporation is in the process of

Q52: Note: This is a Kaplan CPA Review

Q71: Riviera Township reported the following data for