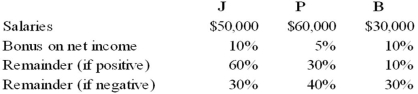

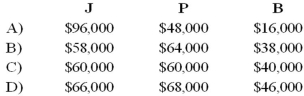

The JPB partnership reported net income of $160,000 for the year ended December 31, 20X8. According to the partnership agreement, partnership profits and losses are to be distributed as follows:  How should partnership net income for 20X8 be allocated to J, P, and B?

How should partnership net income for 20X8 be allocated to J, P, and B?

Definitions:

Persuasive Requests

Communications intended to influence the attitudes or actions of others towards a specific outcome or decision.

Anticipate Resistance

The act of foreseeing and preparing for objections or opposition in the context of persuasion or proposal.

Adjustment

The process of modifying or altering something to achieve a desired fit, appearance, or outcome.

Product Service

A combination of tangible goods and intangible services provided to fulfill the needs or desires of customers.

Q2: Note: This is a Kaplan CPA Review

Q2: Denver Company, a calendar-year corporation, had the

Q3: On January 1, 20X7, Gild Company acquired

Q3: Company A owns 85 percent of Company

Q7: Note: This is a Kaplan CPA Review

Q8: Locus Corporation acquired 80 percent ownership of

Q15: Private Not-For-Profit (NFP) Entities.<br>Select from this list

Q25: The general fund of Gillette levied property

Q29: X Corporation owns 80 percent of Y

Q56: Private Not-For-Profit (NFP) Entities.<br>Select from this list