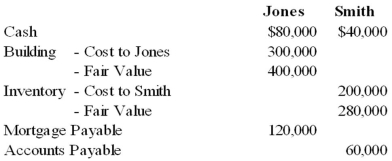

Jones and Smith formed a partnership with each partner contributing the following items:  Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

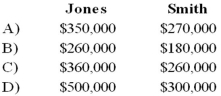

Refer to the above information. What is each partner's tax basis in the Jones and Smith partnership?

Definitions:

Views Of Stress

The different understandings or interpretations of stress, including its causes, effects, and how it is experienced among individuals.

Life Events

Significant occurrences or changes in a person's life that can have a profound psychological and/or physical impact.

Everyday Hassles

Minor daily stresses or annoyances that cumulatively can affect one's mental health and well-being.

Neurons

Specialized cells within the nervous system that transmit information to other nerve cells, muscle, or gland cells.

Q5: On January 1, 20X8, Transport Corporation acquired

Q7: What criteria below would be least important

Q11: Taste Bits Inc. purchased chocolates from Switzerland

Q18: In the AD partnership, Allen's capital is

Q28: Note: This is a Kaplan CPA Review

Q39: Under the modified accrual basis of accounting

Q50: The trial balance of WM Partnership is

Q76: Which of the following statements best describes

Q89: A not-for-profit private college in Virginia created

Q107: The transactions described in the following questions