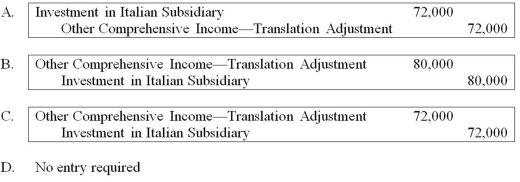

Dover Company owns 90% of the capital stock of a foreign subsidiary located in Italy. Dover's accountant has just translated the accounts of the foreign subsidiary and determined that a debit translation adjustment of $80,000 exists. If Dover uses the fully adjusted equity method for its investment, what entry should Dover record in order to recognize the translation adjustment?

Definitions:

Enforceable Security Interest

A legal claim or lien on collateral that gives a creditor the right to take possession of the property if the debtor defaults on obligations.

Continuation Statement

A legal document filed to extend the duration of a UCC financing statement, maintaining the priority of the secured interest in the collateral.

Financing Statement

A document filed to give public notice of a security interest in personal property, used to perfect a lender's interest in the property as collateral for a loan.

Default

Failure to fulfill a financial obligation or agreement, especially failure to make payments on a loan.

Q1: Which of the following statement is true

Q15: Note: This is a Kaplan CPA Review

Q20: Master Corporation owns 85 percent of Servant

Q23: Trevor Company discloses supplementary operating segment information

Q27: The transactions described in the following questions

Q29: Granite Company issued $200,000 of 10 percent

Q33: Mary is a professor at a large

Q35: Windsor Corporation owns 75 percent of Elven

Q39: Which of the following financial statements would

Q79: Which of the following characteristics are emphasized