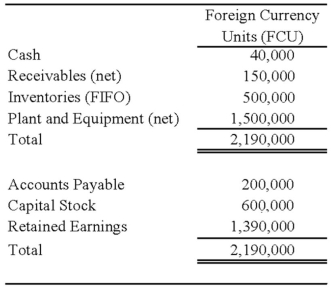

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:  Perth's income statement for 20X8 is as follows:

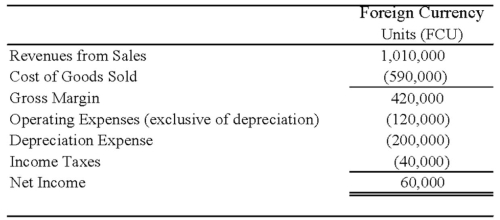

Perth's income statement for 20X8 is as follows:

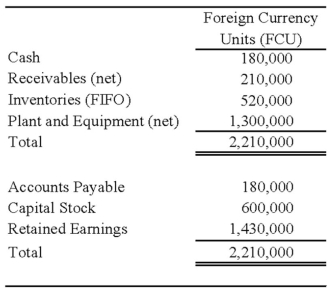

The balance sheet of Perth at December 31, 20X8, is as follows:

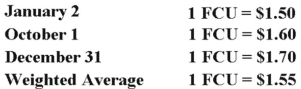

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

Refer to the above information. Assuming Perth's local currency is the functional currency, what is the amount of translation adjustments that result from translating Perth's trial balance into U.S. dollars at December 31, 20X8?

Definitions:

Examples

Specific instances or cases used to illustrate a point, clarify a concept, or provide evidence in support of an argument or discussion.

Theories Of Dreams

Various psychological interpretations of dreams, ranging from Freud's view of them as wish fulfillment to more modern theories suggesting they assist in memory formation, problem-solving, and emotional regulation.

Compare And Contrast

To identify the similarities and differences between two or more subjects.

Absolute Threshold

The minimum amount of sensory stimulation that can be detected 50% of the time.

Q4: A special revenue fund should be used

Q8: On January 1, 20X9, Company A acquired

Q21: For the first quarter of 20X8, Vinyl

Q24: Company X denominated a December 1, 20X9,

Q30: On January 1, 20X7, Pisa Company acquired

Q34: Sigma Company develops and markets organic food

Q40: Identify the regulation that created an entity

Q62: Note: This is a Kaplan CPA Review

Q63: Ponca City issued general obligation bonds to

Q111: Golden Path, a labor union, had the