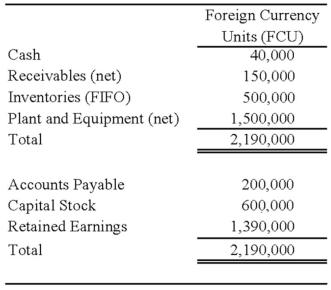

On January 2, 20X8, Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000. Any excess cost over book value is attributable to a patent with a 10-year remaining life. At the date of acquisition, Perth's balance sheet contained the following information:  Perth's income statement for 20X8 is as follows:

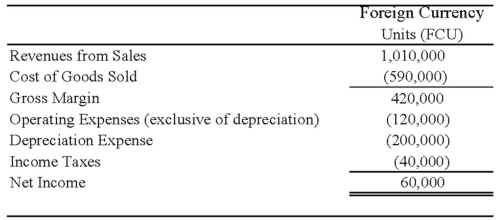

Perth's income statement for 20X8 is as follows:

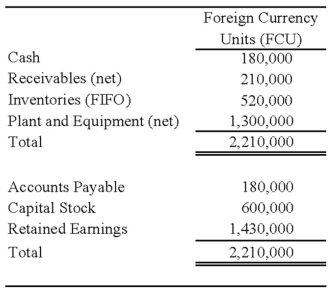

The balance sheet of Perth at December 31, 20X8, is as follows:

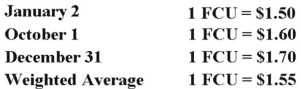

Perth declared and paid a dividend of 20,000 FCU on October 1, 20X8. Spot rates at various dates for 20X8 follow:

Assume Perth's revenues, purchases, operating expenses, depreciation expense, and income taxes were incurred evenly throughout 20X8.

Refer to the above information. Assuming the U.S. dollar is the functional currency, what is Perth's net income for 20X8 in U.S. dollars (include the remeasurement gain or loss in Perth's net income) ?

Definitions:

Disaffirm

To disaffirm means to legally reject or void a contract or agreement, usually because of the incapacity or unfairness to one party involved.

Minor

An individual who is under the age of majority, legally considered as not yet fully adult and under the care of a parent or guardian.

Rescind

To cancel or repeal a contract, agreement, or order, effectively bringing it to an end.

Restatement of Contracts

A legal treatise that organizes, explains, and clarifies the principles of contract law in the United States.

Q4: Mortar Corporation acquired 80 percent of Granite

Q5: The PQ partnership has the following plan

Q14: Lemon Corporation acquired 80 percent of Bricks

Q17: Seattle, Inc. owns an 80 percent interest

Q21: On January 2, 20X8, Johnson Company acquired

Q23: Pie Company acquired 75 percent of Strawberry

Q43: Each of the following questions names an

Q59: On the statement of cash flows prepared

Q60: Forge Company, a calendar-year entity, had 6,000

Q60: John did not join groups and felt