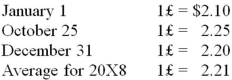

Michigan-based Leo Corporation acquired 100 percent of the common stock of a British company on January 1, 20X8, for $1,100,000. The British subsidiary's net assets amounted to 500,000 pounds on the date of acquisition. On January 1, 20X8, the book values of its identifiable assets and liabilities approximated their fair values. As a result of an analysis of functional currency indicators, Leo determined that the British pound was the functional currency. On December 31, 20X8, the British subsidiary's adjusted trial balance, translated into U.S. dollars, contained $17,000 more debits than credits. The British subsidiary reported income of 33,000 pounds for 20X8 and paid a cash dividend of 8,000 pounds on October 25, 20X8. Included on the British subsidiary's income statement was depreciation expense of 3,500 pounds. Leo uses the fully adjusted equity method of accounting for its investment in the British subsidiary and determined that goodwill in the first year had an impairment loss of 25 percent of its initial amount. Exchange rates at various dates during 20X8 follow:  Based on the preceding information, the receipt of the dividend will result in a credit to the investment account for:

Based on the preceding information, the receipt of the dividend will result in a credit to the investment account for:

Definitions:

Q5: A subsidiary issues bonds. The parent can

Q13: Culver owns 80 percent of the common

Q22: Electric Corporation holds 80 percent of Utility

Q25: Which system helps the SEC accomplish its

Q31: Bob works overtime and he therefore cannot

Q36: Heavy Company sold metal scrap to a

Q44: Myway Company sold equipment to a Canadian

Q45: Which of the following is defined as

Q67: _is the only sociologist ever to have

Q78: A private, not-for-profit hospital received a contribution