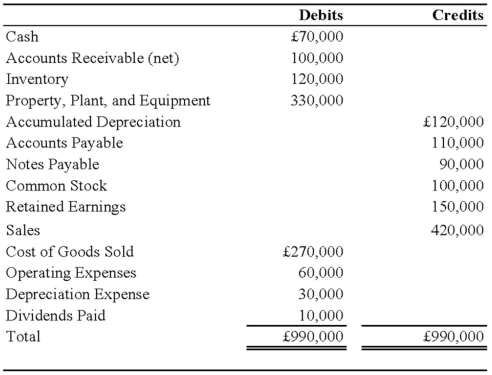

On January 1, 2008, Pace Company acquired all of the outstanding stock of Spin PLC, a British Company, for $350,000. Spin's net assets on the date of acquisition were 250,000 pounds (£). On January 1, 2008, the book and fair values of the Spin's identifiable assets and liabilities approximated their fair values except for property, plant, and equipment and trademarks. The fair value of Spin's property, plant, and equipment exceeded its book value by $25,000. The remaining useful life of Spin's equipment at January 1, 2008, was 10 years. The remainder of the differential was attributable to a trademark having an estimated useful life of 5 years. Spin's trial balance on December 31, 2008, in pounds, follows:

Additional Information

1. Spin uses the FIFO method for its inventory. The beginning inventory was acquired on December 31, 2007, and ending inventory was acquired on December 26, 2008. Purchases of £300,000 were made evenly throughout 2008.

2. Spin acquired all of its property, plant, and equipment on March 1, 2006, and uses straight-line depreciation.

3. Spin's sales were made evenly throughout 2008, and its operating expenses were incurred evenly throughout 2008.

4. The dividends were declared and paid on November 1, 2008.

5. Pace's income from its own operations was $150,000 for 2008, and its total stockholders' equity on January 1, 2008, was $1,000,000. Pace declared $50,000 of dividends during 2008.

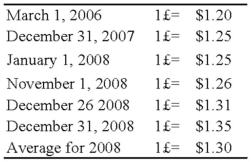

6. Exchange rates were as follows:

Required:

1) Prepare a schedule translating the trial balance from British pounds into U.S. dollars. Assume the pound is the functional currency.

2) Assume that Pace uses the fully adjusted equity method. Record all journal entries that relate to its investment in the British subsidiary during 2008. Provide the necessary documentation and support for the amounts in the journal entries, including a schedule of the translation adjustment related to the differential.

3) Prepare a schedule that determines Pace's consolidated comprehensive income for 2008.

Definitions:

Net Present Value

The difference between the current value of cash inflows and the current value of cash outflows over a period of time, used in capital budgeting to analyze the profitability of an investment.

Required Rate

The minimum yearly earnings percentage necessary to lure individual or corporate investors into a specific project or security.

Payback Period

The timeframe required for an investment to generate cash flows sufficient to recover its initial cost.

AAR

Average Annual Return, which measures the average return on an investment over a multi-year period.

Q11: Griffin and Rhodes formed a partnership on

Q12: Economic globalization is<br>A) a place in Europe

Q13: Culver owns 80 percent of the common

Q39: Heavy Company sold metal scrap to a

Q42: Emile Durkheim is associated with the_ perspective.<br>A)

Q46: Blue Corporation holds 70 percent of Black

Q53: U.S. sociology was reshaped during the 1960s

Q57: Mercury Company is a subsidiary of Neptune

Q75: Note: This is a Kaplan CPA Review

Q81: Edna is a sociologist. She is organizing