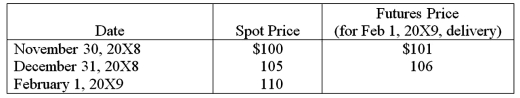

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:  The information for the change in the fair value of the options follows:

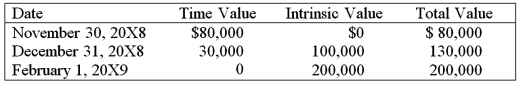

The information for the change in the fair value of the options follows:

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

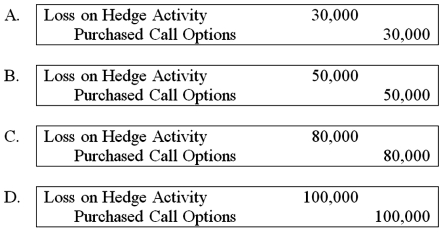

Based on the preceding information, which of the following adjusting entries would be required on December 31, 20X8?

Definitions:

Nominal-Level

Pertains to data classification into non-numeric categories that cannot be logically ordered or ranked.

Positive Correlation

A relationship between two variables where an increase in one variable is associated with an increase in the other variable.

Increases

A rise in magnitude, quantity, or value of something.

Negative Correlation

A bond between two variables in which the elevation of one corresponds with the reduction of the other.

Q6: Mortar Corporation acquired 80 percent of Granite

Q12: A value is a socially shared idea

Q12: Hunter Corporation holds 80 percent of the

Q19: Denver Corporation owns 25 percent of the

Q20: Positions we are born into, such as

Q34: The cases of children who were raised

Q38: In accordance with the Single Audit Act

Q42: The BIG Partnership has decided to liquidate

Q44: Blue Ridge Township uses the consumption method

Q50: Vision Corporation acquired 75 percent of the