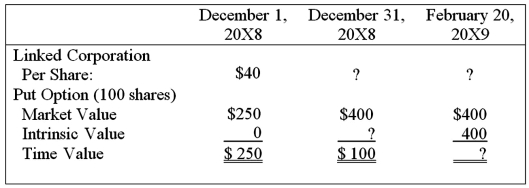

On December 1, 20X8, Winston Corporation acquired 100 shares of Linked Corporation at a cost of $40 per share. Winston classifies them as available-for-sale securities. On this same date, it decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $250, an at-the-money put option to sell the 100 shares at $40 per share. The option expires on February 20, 20X9. Selected information concerning the fair values of the investment and the options follow:  Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

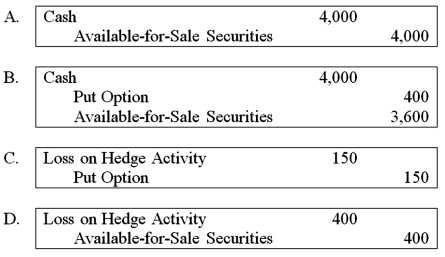

Based on the preceding information, which of the following journal entries will be made on February 20, 20X9?

Definitions:

Dividend Income

Income received from owning shares of a company that pays dividends.

Dividend Per Share

The total dividends declared by a corporation divided by the number of outstanding shares, indicating how much each share receives in dividends.

Stock Split

A corporation's decision to divide its existing shares into multiple shares to boost the liquidity of the shares, though the market capitalization remains the same.

Market Price

The prevailing cost at which a service or asset is offered for sale or purchase in the open market.

Q2: The following condensed balance sheet is presented

Q13: A view that focuses on the immediate

Q24: The following condensed balance sheet is presented

Q31: Under the temporal method, which of the

Q54: Wakefield Company uses a perpetual inventory system.

Q56: Under the modified accrual basis of accounting,

Q60: The general fund of Sun City was

Q60: The town of Decorah issued general obligation

Q65: Herman played on a softball team and

Q78: Intelligence is either inherited or learned.