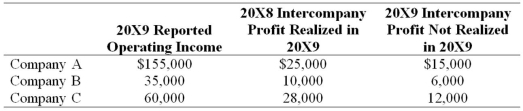

Company A owns 85 percent of Company B's stock and 80 percent of Company C's stock. All acquisitions were made at book value. The fair values of noncontrolling interests at the time of acquisition were equal to the proportionate share of the book values of the companies. The companies file a consolidated tax return each year and in 20X9 paid a total tax of $112,000. Each company is involved in a number of intercompany inventory transfers each period. Information on the companies' activities for 20X9 is as follows:  Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

Based on the information provided, income to the controlling interest for 20X9 is:

Definitions:

Product Costs

Costs associated directly with the production of goods, including direct material, direct labor, and manufacturing overhead.

Period Costs

Expenses that are not directly tied to the production process and are therefore expensed in the period they are incurred, such as administrative and selling expenses.

Direct Manufacturing Cost

Costs that are directly attributable to the production of goods, such as raw materials and direct labor expenses.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold in a company, including the cost of materials and direct labor.

Q3: For Cooley, the process whereby our self-image

Q16: Presenting oneself to others for purposes of

Q18: Michigan-based Leo Corporation acquired 100 percent of

Q26: New Life Corporation has just finished preparing

Q37: Granite Company issued $200,000 of 10 percent

Q37: The attitude that oneʹs own culture is

Q42: Flyer Corporation holds 90 percent of Kite

Q43: Which of the following items are important

Q46: Which division of the SEC develops and

Q64: Piaget suggested that virtually all children go