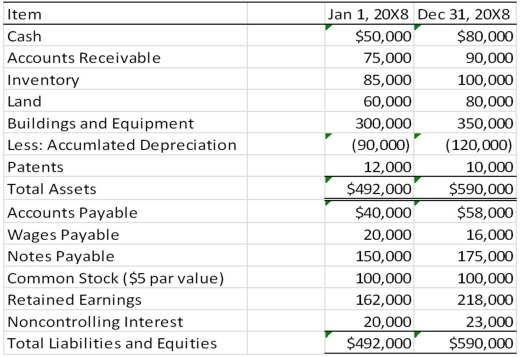

Locus Corporation acquired 80 percent ownership of Stereo Company on January 1, 20X6, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of Stereo Company. Consolidated balance sheets at January 1, 20X8, and December 31, 20X8, are as follows:

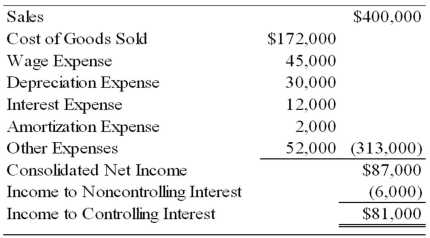

The consolidated income statement for 20X8 contained the following amounts:

Locus and Stereo paid dividends of $25,000 and $15,000, respectively, in 20X8.

Required:

1) Prepare a worksheet to develop a consolidated statement of cash flows for 20X8 using the indirect method of computing cash flows from operations.

2) Prepare a consolidated statement of cash flows for 20X8.

Definitions:

Own Identity

Refers to an individual's sense of self, defined by personal attributes, values, and beliefs that distinguish oneself from others.

Accommodate

To make adjustments or provisions for someone's needs, desires, or conditions.

Friends with Benefits

A relationship between two people who engage in sexual activities without the commitment or label of a traditional romantic relationship.

Q5: Mortar Corporation acquired 80 percent of Granite

Q6: In 20X6 and 20X7, each of Putney

Q13: Which of the following types of securities

Q24: Company X denominated a December 1, 20X9,

Q28: All assets and liabilities are transferred to

Q30: Moon Corporation issued $300,000 par value 10-year

Q43: On January 1, 20X7, Pisa Company acquired

Q43: If 1 British pound can be exchanged

Q59: An)_ is a collection of people who

Q77: The general fund of Caldwell had the