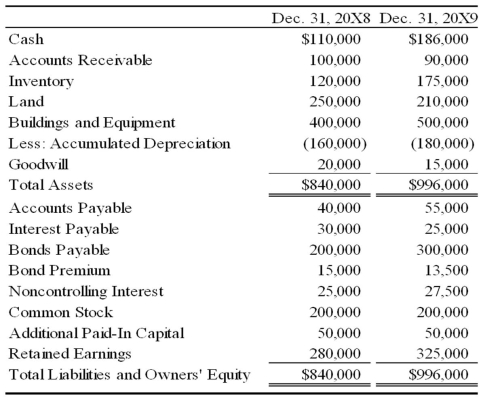

Boycott Company holds 75 percent ownership of Fred Corporation. The consolidated balance sheets as of December 31, 20X8, and December 31, 20X9, are as follows:

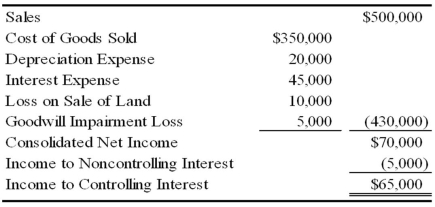

The 20X9 consolidated income statement contained the following amounts:

Boycott acquired its investment in Fred on January 1, 20X6, for $120,000. At that date, the fair value of the noncontrolling interest was $40,000, and Fred reported net assets of $130,000. A total of $20,000 of the differential was assigned to goodwill. The remainder of the differential was assigned to equipment with a remaining life of 10 years from the date of combination.

Boycott sold $100,000 of bonds on December 31, 20X9, to assist in generating additional funds. Fred reported net income of $20,000 for 20X9 and paid dividends of $10,000. Boycott reported 20X9 equity-method net income of $75,000 paid dividends of $20,000 for the year.

Required:

1) Prepare a worksheet to develop a consolidated statement of cash flows for 20X9 using the indirect method of computing cash flows from operations.

2) Prepare a consolidated statement of cash flows for 20X9.

Definitions:

Profit

The financial gain achieved when the revenue from business activities exceeds the expenses, costs, and taxes needed to sustain the activity.

Marginal Cost

The escalation in cumulative price involved in fabricating one extra unit of a product or service.

Average Revenue

The amount of income generated per unit of sale or service offered, calculated by dividing total revenue by the number of units sold.

Profit Maximizes

The process by which a firm determines the price and output level that leads to the highest profit.

Q7: Simon Company has two foreign subsidiaries. One

Q13: Schools are expected to teach young children

Q29: On July 1, 20X8, Fair Logic Corporation

Q31: When Tibetans and Burmese greet their friends

Q36: Sky Corporation owns 75 percent of Earth

Q41: If a collection of people share some

Q44: Myway Company sold equipment to a Canadian

Q46: Blue Corporation holds 70 percent of Black

Q52: On January 2, 20X8, Johnson Company acquired

Q71: All of the following are elements of