Note: This is a Kaplan CPA Review Question

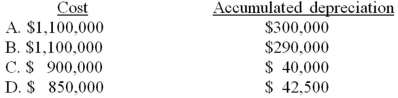

On January 1, 20X1, Poe Corp. sold a machine for $900,000 to Saxe Corp., its wholly-owned subsidiary. Poe paid $1,100,000 for this machine, which had accumulated depreciation of $250,000. Poe estimated a $100,000 salvage value and depreciated the machine on the straight-line method over 20 years, a policy which Saxe continued. In Poe's December 31, 20X1, consolidated balance sheet, this machine should be included in cost and accumulated depreciation as:

Definitions:

Controlled by Courts

Refers to legal matters or procedures directly overseen or managed by judicial authorities.

Certified Union

A labor organization officially recognized to represent and negotiate on behalf of employees in a specific workplace or industry.

Bargaining Unit

A group of employees who have been certified.

Employment Standards Act

Legislation outlining the minimum standards of employment, including wages, working hours, leaves, and termination procedures, among other worker rights.

Q7: On June 30, 20X8, String Corporation incurred

Q7: Vision Corporation acquired 75 percent of the

Q8: Light Corporation owns 80 percent of Sound

Q10: ABC Corporation purchased land on January 1,

Q18: Granite Company issued $200,000 of 10 percent

Q38: In the AD partnership, Allen's capital is

Q48: Roberta is the manager of a bank

Q75: A macro view focuses on the immediate

Q85: How can sports be used to explain

Q86: Like children, adults go through_ , the