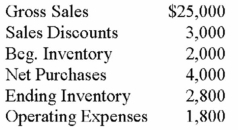

Al Flynn has gathered the following information. Could you help Al calculate his gross profit?

Definitions:

Legal Structure

The legal organization of a company, determining its legal personality, liability, and taxation methods. Examples include sole proprietorship, partnership, corporation, and LLC.

C Corporation

A business structure where the company is taxed separately from its owners, offering limited liability protection to its shareholders.

Legally Liable

The state of being legally responsible for something, typically involving a financial or other obligation.

Sole Proprietorship

A business structure where a single individual owns, manages, and is responsible for all aspects of the business.

Q3: The monthly payment is calculated by totaling

Q9: Bond quotes are stated in percents of

Q17: All but which one of the following

Q20: The maturity value of a $20,000, 7%,

Q22: The retail method:<br>A)Is not an estimate<br>B)Does not

Q27: Cost of goods sold equals cost of

Q28: An amortization schedule shows:<br>A)Balance of interest outstanding<br>B)The

Q48: Jill Hartman earns $750 per week plus

Q53: How did Albert Kossel contribute to our

Q60: Janice Tax, an accountant for Flee Corp.,