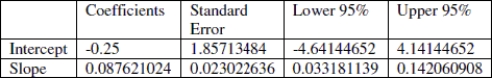

The regression output below is the result of testing whether there is an association between the number of hours of sleep a student had the night before an exam and the number of questions answered correctly on the exam. Assume that the conditions of the linear regression model are satisfied. What is the 95% confidence interval for the intercept (rounded to the nearest hundredth) ? Does this interval support the theory that the intercept is zero? Choose the statement that summarizes your answer in context.

Definitions:

Risk-Free Return

The return on an investment with no risk of financial loss, typically associated with government bonds.

Treynor Measure

A performance metric on investment funds that accounts for the risk taken by the investment relative to the market risk as measured by beta.

Risk-Free Return

The theoretical rate of return of an investment with zero risk of financial loss.

Dollar-Weighted Return

A method of calculating an investment's return that takes into account the timing and size of cash flows, providing a more accurate measure of personal investment performance.

Q11: Suppose each of these families is given

Q27: The economic impact of fishing for nearly

Q28: Suppose that runner height (in inches)and finish

Q45: Pick the statement that best describes the

Q47: Which of the following statements is true

Q47: For normal goods, which of the following

Q47: Report the 95% confidence interval for the

Q52: What fraction represents the proportion of people

Q52: Using the data from the table, sketch

Q57: It is determined that a positive linear