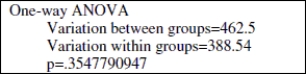

Use the following information to answer the question. Researchers want to test whether the color of a vehicle ticketed for speeding has an effect on the amount of the ticket. Four vehicle colors were used for the study-- red, white, black, and silver. Thirty vehicles were randomly assigned to each group. Use the output below to answer the question.

-Choose the correct conclusion for the hypothesis that vehicle color affects the amount of a speeding ticket. Assume all ANOVA test conditions have been satisfied.

Definitions:

Structural

Relating to the underlying or foundational aspects or structures of a system, organization, or building.

Lump-Sum Tax

A tax that is a fixed amount and does not vary with the taxpayer's income or consumption levels.

Proportional Tax

A tax system where the tax rate remains constant regardless of the amount subject to tax, meaning everyone pays the same proportion of their income.

Regressive Tax

A tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases, disproportionately affecting lower-income individuals.

Q9: In your own words, explain what the

Q17: Compare the sampling distributions of the normally

Q18: Which of the following shifts the supply

Q26: The supply curve slopes upward when graphed

Q30: Based on the scatterplot, estimate the correlation

Q38: State the slope of the regression line.

Q43: Researches want to find out which U.

Q45: Suppose that environmentalists monitor algae levels in

Q47: Describe one benefit to a cluster sampling

Q72: The figure above shows supply curves for