The statement

Definitions:

Tax Tables

Charts provided by the IRS to help taxpayers determine how much income tax they owe based on their income level and filing status.

Tax Rate Structure

The specific system or method of imposing taxes at different rates on different levels of income or types of transactions.

Revenue Rulings

Official interpretations of tax laws issued by the Internal Revenue Service that guide taxpayers in compliance.

Revenue Procedures

Official statements published by the IRS that outline procedures, practices, and administrative aspects of tax law to guide taxpayers.

Q1: The process by which organizations move from

Q6: Relational operators allow you to numbers.<br>A)average<br>B)verify<br>C)add<br>D)compare<br>E)multiply

Q8: The function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3767/.jpg" alt="The function

Q12: A is a container that provides quick

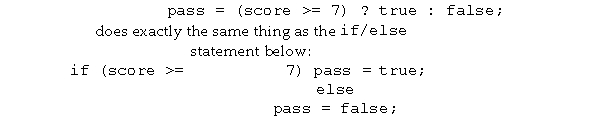

Q12: Assuming goodData is a Boolean variable, the

Q17: A library function that looks for the

Q25: Organizations that operate in the same environment

Q29: _is recognizing the opportunity to satisfy a

Q47: Any arithmetic operation may be performed on

Q77: A large restaurant chain decides that they