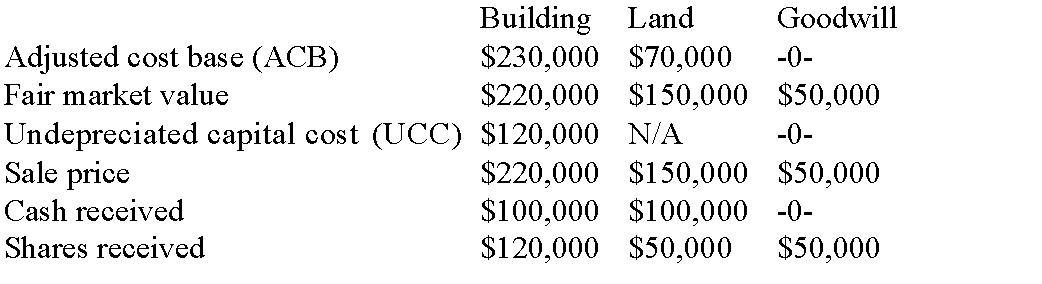

Janko Corp. has transferred three assets to Jumbo Corp., a Canadian controlled private corporation, under section 85 of the Income Tax Act. The following

assets were transferred:

Required:

Required:

Determine the following amounts:

a) The minimum amount that Janko may elect to transfer each asset.

b) Janko's income or loss for tax purposes

c) Jumbo's ACB for the assets acquired.

d) The ACB of the shares received by Janko.

e) The PUC of the shares received by Janko.

Definitions:

Government Revenues

The total money received by the government from taxes as well as non-tax sources like charges and fees.

Total Revenue

The total amount of money generated by the sale of goods or services before any expenses are subtracted.

Domestic Producers

Companies or individuals that produce goods and services within their home country.

Foreign Producers

Foreign producers are companies or individuals who produce goods or services outside the domestic market.

Q31: Both Parkinson's Disease and dietary deficiencies can

Q41: Residential treatment<br>A) has been found to be

Q62: You should predict that the most productive

Q67: Work groups typically generate more positive synergy

Q73: In the communication process, decoding should precede

Q93: Decreasing sociocultural risk factors for the development

Q99: Community-based facilities that provide aftercare are typically

Q103: What evidence is there that genes are

Q115: A group must have at least two

Q117: When a person manipulates information so that