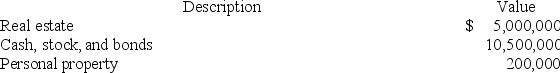

At his death in 2019, Nathan owned the following property:

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 25-1.)

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 25-1.)

Definitions:

Buddy System

A safety measure in which two people, the "buddies," agree to keep an eye on each other and provide assistance when needed, often used in risky environments or activities.

Patient's Independence

The empowerment and autonomy of a patient to make decisions and manage their own care to the best of their ability.

Somatic Symptom Disorder

A mental disorder characterized by an intense focus on physical symptoms that cause significant distress or problems in functioning.

Treatment Plan

A detailed outline created by healthcare providers to guide the course of treatment for a patient's specific health conditions.

Q7: Which of the following statements is true

Q12: Vanessa contributed $20,000 of cash and land

Q13: Clampett, Inc., has been an S corporation

Q36: Most services are sourced to the state

Q38: "Outbound taxation" deals with the U.S. tax

Q49: No deductions are allowed when calculating the

Q62: Ypsi Corporation has a precredit U.S. tax

Q103: The IRS may consent to an early

Q107: Which of the following is the correct

Q133: C corporations that elect S corporation status