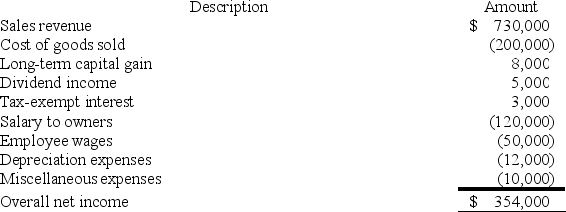

XYZ Corporation (an S corporation) is owned by Jane and Rebecca, who are each 50 percent shareholders. At the beginning of the year, Jane's basis in her XYZ stock was $40,000. XYZ reported the following tax information for 2019.

Required:

Required:

a. What amount of ordinary business income is allocated to Jane?

b. What is the amount and character of separately stated items allocated to Jane?

c. What is Jane's basis in her XYZ Corporation stock at the end of the year?

Definitions:

Inability To Wake Up

A condition where an individual finds it extremely difficult to wake from sleep, potentially due to medical issues or sleep disorders.

Marijuana

A psychoactive drug from the Cannabis plant, used for medical or recreational purposes.

Long-Term Memory Loss

A condition that affects the ability to recall events, information, or experiences from the distant past.

Paranoia

A mental condition characterized by delusions of persecution, unwarranted jealousy, or exaggerated self-importance, often disconnected from reality.

Q4: Which requirement must be satisfied in order

Q23: Which of the following assets would not

Q26: Which of the following is/are a component

Q38: Robin transferred her 60 percent interest to

Q44: Half Moon Corporation made a distribution of

Q55: Which of the following statements best describes

Q71: This year Nathan transferred $7 million to

Q91: Rachelle transfers property with a tax basis

Q99: Which of the following statements is true

Q101: All of the following are false regarding