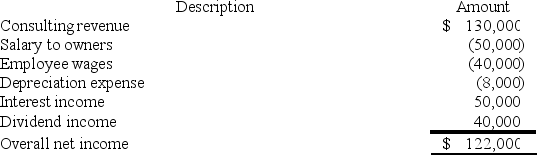

RGD Corporation was a C corporation from its inception in 2015 through 2018. However, it elected S corporation status effective January 1, 2019. RGD had $50,000 of earnings and profits at the end of 2018. RGD reported the following information for its 2019 tax year.

What amount of excess net passive income tax is RGD liable for in 2019? (Round your answer for excess net passive income to the nearest thousand.)

What amount of excess net passive income tax is RGD liable for in 2019? (Round your answer for excess net passive income to the nearest thousand.)

Definitions:

Lemon Glycerin Swabs

Swabs coated with lemon and glycerin used to moisten and cleanse the patient's oral cavity.

Cardiac Arrests

Sudden stops in effective blood circulation due to the failure of the heart to contract effectively, which requires immediate medical intervention to prevent death.

Hard Plastic

A durable material made from synthetic polymers, known for its rigidity and resistance to impact.

Pharynx

A muscular tube that connects the mouth and nasal passages with the esophagus and larynx, serving as a pathway for air and food.

Q1: Greg, a 40 percent partner in GSS

Q23: Gerald received a one-third capital and profit

Q32: A calendar-year corporation has positive current E&P

Q45: Goose Company is owned equally by Val

Q57: A valuation allowance can reduce both a

Q61: Which of the following foreign taxes is

Q80: Body mass index is a measure of

Q100: Which of the following statements best describes

Q107: Which statement below lists the essential components

Q129: AIRE was initially formed as an S