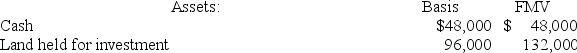

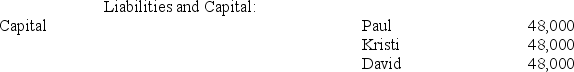

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000. Just prior to the sale, Paul's outside and inside bases in KDP are $48,000. KDP's balance sheet includes the following:

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

Definitions:

Operationalization

The process of defining measurement criteria for abstract concepts to enable their empirical, quantitative measurement.

Abstract Concept

A theoretical idea that is not associated with any specific physical object or real entity, often requiring complex thought and understanding.

Testable Variable

An element or factor in a scientific experiment that can be altered and measured to determine its effects on the outcome.

Psychological Conflicts

Internal struggles resulting from incompatible or opposing desires, demands, or impulses.

Q20: Santa Fe Corporation manufactured inventory in the

Q24: Which tax rule applies to an excess

Q34: Viking Corporation is owned equally by Sven

Q40: The estimated tax payment rules for S

Q42: Which of the following statements regarding nonqualified

Q62: On June 12, 20X9, Kevin, Chris, and

Q69: Suppose that at the beginning of 2019

Q75: Tyson is a 25 percent partner in

Q83: An applicable credit is subtracted in calculating

Q91: In what order should the tests to