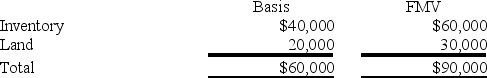

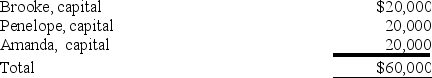

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Definitions:

Constrained Resource

A limited resource within a production process that can restrict the output or efficiency of the manufacturing operations.

Constrained Machine

A resource in the manufacturing process that limits the total output because it has the lowest capacity of any of the resources.

Joint Production Process

A manufacturing operation that simultaneously produces two or more outputs from a common input or process.

Split-off Point

The stage in a production process where multiple products are generated from a common input, and each product can then be sold or processed further.

Q8: Assume that at the end of 2019,

Q31: A hybrid entity established in Ireland is

Q35: Which of the following statements best describes

Q40: Madison Corporation reported taxable income of $400,000

Q42: Ted is a 30 percent partner in

Q62: On June 12, 20X9, Kevin, Chris, and

Q66: Packard Corporation transferred its 100 percent interest

Q82: Which of the following foreign taxes is

Q83: Loon, Inc. reported taxable income of $600,000

Q84: Mighty Manny, Incorporated, manufactures ice scrapers and