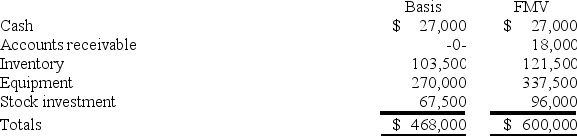

Victor is a one-third partner in the VRX Partnership, with an outside basis of $156,000 on January 1. Victor sells his partnership interest to Raj on January 1 for $200,000 cash. The VRX Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased seven years ago. What is the amount and character of Victor's gain or loss on the sale of his partnership interest?

Definitions:

Q11: Roberta transfers property with a tax basis

Q22: Randolph is a 30 percent partner in

Q38: At his death Tyrone's life insurance policy

Q54: Which of the following statements best describes

Q57: Randolph is a 30 percent partner in

Q61: The character of each separately stated item

Q73: A rectangle with a triangle within it

Q81: A valuation allowance is recorded against a

Q83: Loon, Inc. reported taxable income of $600,000

Q111: Aiden transferred $2 million to an irrevocable