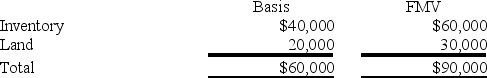

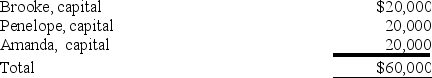

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Definitions:

Vertical Mergers

Mergers between companies that operate at different stages within an industry's supply chain, aiming to increase synergies and efficiency.

IRS

The Internal Revenue Service, the U.S. federal agency responsible for administering and enforcing the tax laws and collecting taxes.

Tax Savings

Reductions in tax payments achieved through allowable deductions, credits, or other legal means.

Merger

The combination of two or more companies into a single entity, usually to increase market share or efficiency.

Q31: Sarah is a 50 percent partner in

Q50: Which of the following tax benefits does

Q55: Economic presence always creates sales tax nexus.

Q61: The Wayfair decision held that an out-of-state

Q61: The term "E&P" is well-defined in the

Q63: Which of the following statements regarding book-tax

Q68: Gordon operates the Tennis Pro Shop in

Q76: Cecilia, a Brazilian citizen and resident, spent

Q95: Big Company and Little Company are both

Q97: For estimated tax purposes, a "large" corporation