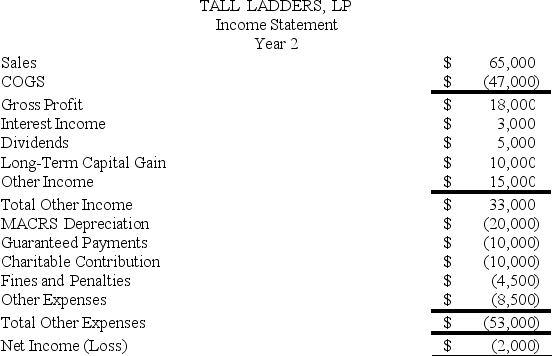

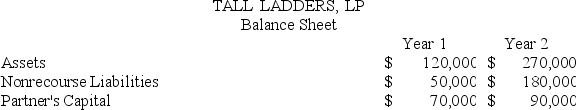

At the end of Year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For Year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following income statement and balance sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of Year 2?

Definitions:

Supervisors

Individuals within an organization responsible for overseeing the work of others and ensuring tasks are completed effectively.

Line Organization

Organizational structure that establishes a direct flow of authority from the chief executive to subordinates.

Matrix Organizational Structure

An organizational structure that combines two or more types of organizational structures, typically functional and product-based divisions.

Hi-Tech

Referring to the latest technology and equipment that are both advanced and sophisticated.

Q4: Business income includes all income earned in

Q11: MWC is a C corporation that uses

Q44: AmStore Inc. sold some of its heavy

Q49: Which of the following statements concerning the

Q52: Roberto and Reagan are both 25-percent owner/managers

Q56: The definition of property as it relates

Q64: If a C corporation incurs a net

Q76: Sweetwater Corporation declared a stock distribution to

Q79: Large corporations (corporations with more than $1,000,000

Q91: In what order should the tests to