Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

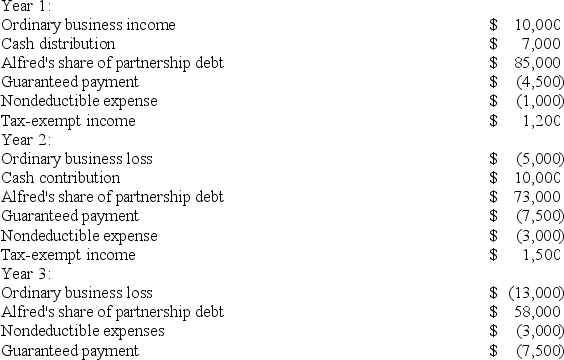

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Definitions:

Sporophyte

Spore-forming diploid body that forms in the life cycle of land plants and some multicelled algae.

Xylem

A type of vascular tissue in plants responsible for the transportation of water and nutrients from the roots to various parts of the plant.

Conduct Water

The process by which water is transported throughout plants, particularly from roots to leaves, through structures like xylem vessels.

Minerals

Naturally occurring, inorganic substances with a definite chemical composition and crystalline structure.

Q2: Tammy owns 100 shares in Star Struck

Q18: Corporation A receives a dividend from Corporation

Q39: In January 2019, Khors Company issued nonqualified

Q49: The specific identification method is a method

Q63: Rainier Corporation, a U.S. corporation, manufactures and

Q69: Suppose that at the beginning of 2019

Q81: The dividends received deduction is designed to

Q91: Catherine is a 30 percent partner in

Q103: For tax purposes, a corporation may deduct

Q115: Super Sadie, Incorporated, manufactures sandals and distributes