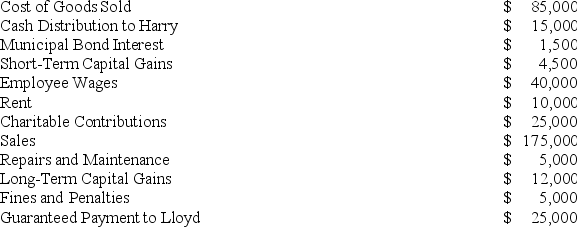

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year?

Definitions:

Fine

A monetary penalty imposed by a court on a person or entity as punishment for an offense or breach of law.

Trade Regulation Rules

Rules established by regulatory authorities to govern the practices of businesses, aimed at ensuring fairness in commerce and preventing anticompetitive behavior.

Consent Order

A legal agreement approved by a court, usually resolving a dispute between parties without admission of guilt or liability.

Cease-And-Desist Order

A legal order issued by a governmental agency or court to halt a particular activity or practice deemed illegal or harmful.

Q3: Which of the following stock distributions would

Q11: Roberta transfers property with a tax basis

Q11: If a C corporation incurred a net

Q25: A distribution from a corporation to a

Q26: Which of the following does NOT create

Q36: Packard Corporation reported taxable income of $1,000,000

Q51: Terrapin Corporation incurs federal income taxes of

Q96: Which of the following statements regarding liquidating

Q105: The rules for consolidated reporting for financial

Q112: Jackson is the sole owner of JJJ