Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

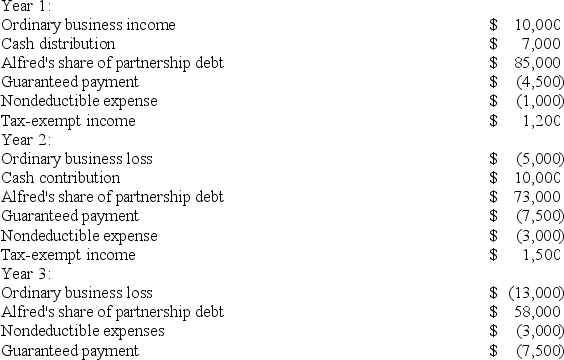

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Definitions:

Downsloping

Characteristic of a demand curve, indicating that as the price decreases, the quantity demanded increases, assuming all other factors remain constant.

Pure Competition

A market structure characterized by a large number of small firms, homogenous products, and free entry and exit, leading to perfect competition.

Nonprice Competition

A strategy where businesses focus on improving product quality, promoting innovation, or providing exceptional service instead of lowering prices to compete.

Differentiated Products

Goods or services that are distinguished from similar products by quality, features, branding, or customer service, allowing them to compete apart from price alone.

Q11: The focus of ASC 740 is on

Q20: At the beginning of the year, Clampett,

Q36: Jorge is a 60-percent owner of JJ

Q57: Carlos transfers property with a tax basis

Q61: The Wayfair decision held that an out-of-state

Q66: Packard Corporation transferred its 100 percent interest

Q67: Which of the following isn't a typical

Q79: Suppose SPA Corp. was formed by Sara

Q85: Neal Corporation was initially formed as a

Q91: Catherine is a 30 percent partner in