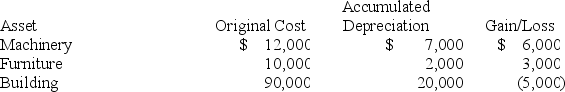

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Normal Distributions

A type of statistical distribution where data is symmetrically distributed around the mean, showing that data near the mean are more frequent in occurrence than data far from the mean.

Standard Deviation

A statistical measure representing the dispersion or variability of a set of data points, indicating how much the individual data points deviate from the mean.

Measurements

Measurements are the process of obtaining quantitative data or observations of variables, typically using standardized instruments or methods, to assess, compare, or track performance or phenomena.

Grade Requirements

The standards or specifications that need to be met in terms of quality for products, materials, or academic achievement.

Q4: The chilling effect of interest arbitration refers

Q9: C corporations with annual average gross receipts

Q14: This year Clark leased a car to

Q27: Stock distributions are always tax-free to the

Q35: Which of the following sections does not

Q36: For which of the following may an

Q37: Which of the following is correct regarding

Q54: A stock redemption is always treated as

Q76: The gain or loss realized on the

Q76: Purple Rose Corporation reported pretax book income