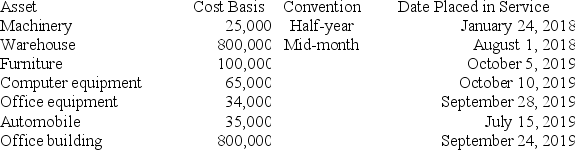

Boxer LLC has acquired various types of assets recently used 100 percent in its trade or business. Below is a list of assets acquired during 2018 and 2019:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2018, but would like to take advantage of the §179 expense and bonus depreciation for 2019 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2019. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10. ) (Round final answer to the nearest whole number.)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2018, but would like to take advantage of the §179 expense and bonus depreciation for 2019 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2019. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10. ) (Round final answer to the nearest whole number.)

Definitions:

Life Cycles

The series of changes in the life of an organism, including reproduction, growth, and in some cases, aging and death. It can also apply to products, organizations, and systems as they go through stages from inception to demise.

Flexible And Efficient

The ability of an entity, such as an organization or individual, to adapt to changes while maintaining high productivity and effectiveness.

Mechanistic Structure

A form of organizational structure that is rigid and tightly controlled, emphasizing a hierarchical, top-down management approach and fixed duties.

Organic Structure

An organizational design that is flexible and decentralized, with low levels of formalization, encouraging collaboration and adaptability to change.

Q5: Schedule M-1 reconciles from book income to

Q16: Colbert operates a catering service on the

Q31: Which of the following is correct regarding

Q38: Only accelerated depreciation is recaptured for §1245

Q40: Which of the following statements regarding book-tax

Q40: Ajax Computer Company is an accrual-method calendar-year

Q59: Unionization rates for women aged 45-54 has

Q60: Which of the following is correct regarding

Q75: Which of the following is allowable as

Q83: The decisions of arbitrators are not subject