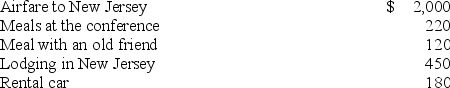

Shelley is self-employed in Texas and recently attended a two-day business conference in New Jersey. After Shelley attended the conference, she had dinner with an old friend who lived nearby. Shelly documented her expenditures (described below) . What amount can Shelley deduct?

Definitions:

Special-Interest Groups

Organizations formed to represent the concerns and aims of specific groups and interests in political and policy-making processes, often lobbying for favorable legislation and regulation.

Organized Labor

Groups of workers united in trade unions or similar organizations to protect their rights and advocate for better conditions and wages.

Hiram Johnson

An American political leader known for his progressive reforms as the Governor of California and later as a U.S. Senator.

Q26: Which of the following possibly restricts the

Q44: C corporations and S corporations are separate

Q45: Corporations compute their dividends received deduction by

Q58: Lucky Strike Mine (LLC) purchased a silver

Q58: Owners who work for entities taxed as

Q85: Describe four "hardball tactics" that could be

Q95: Arlington LLC purchased an automobile for $55,000

Q98: A business can deduct the cost of

Q106: A corporation may carry a net capital

Q110: Mary exchanged an office building used in