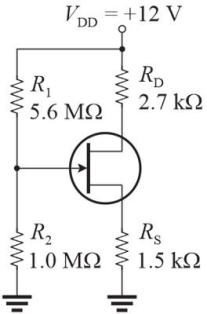

Figure 3 Assume IDSS = 3.5 mA and VGS(off) = -2 V.

Figure 3 Assume IDSS = 3.5 mA and VGS(off) = -2 V.

-If a JFET bias circuit is designed with current- source biasing,

Definitions:

Deferred Tax Asset

An accounting term that refers to a situation where a business has paid more taxes or estimates that it will pay more taxes than it will owe.

Warranty Expense

Costs a company incurs due to repairing or replacing products under warranty.

Tax Penalty

A tax penalty is a fine or charge imposed by governmental authorities on individuals or organizations for failing to comply with tax laws.

Deferred Tax Asset

An asset on the balance sheet representing taxes paid or carried forward but not yet realized. This can arise due to timing differences between the recognition of income and expenses for financial reporting and tax purposes.

Q1: Which of the following is false?<br>A)Expressed warranties

Q2: An OTA is a current- to- voltage

Q3: The procedure to get money back or

Q7: Refer to Figure 2. The circuit is

Q7: Refer to Figure 1. The Q- point

Q9: A constructive choice is a timely decision

Q14: RIN(BASE)will increase if IE decreases.

Q19: The measurement unit for fiac is<br>A)the ohm<br>B)the

Q20: Refer to Figure 3. Rin is approximately<br>A)1.0

Q27: An ISO124 isolation amplifier has an internal