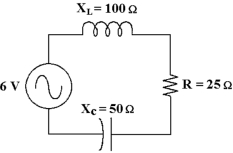

-If the frequency decreases in Figure 13 -1, the impedance initally .

And the current initially

Definitions:

Payroll Tax Expense

Payroll Tax Expense represents the taxes that an employer is liable to pay based on the wages and salaries of employees, including social security, Medicare, and unemployment taxes.

Employer's Payroll Taxes

Taxes that employers are responsible for paying on behalf of their employees, including Social Security, Medicare, and unemployment taxes.

Payroll Register

A detailed document that records the earnings, deductions, and net pay for all employees for each pay period.

Gross Payroll

The total amount of money paid by an employer to its employees before deductions such as taxes, retirement contributions, and health insurance.

Q4: A(n)is a material that has many free

Q21: The voltage leads the current in an

Q21: Circuit ground or chassis ground can be

Q27: The total impedance equals the resistance of

Q29: If a 1 MΩ resistor, 0.47 MΩ

Q39: Power rating for a resistor is mainly

Q48: The impedance of a series RL circuit

Q48: What is the primary current in Figure

Q49: Calculating current for a series resistor circuit

Q58: Sensitivity training seeks to increase participants' insight