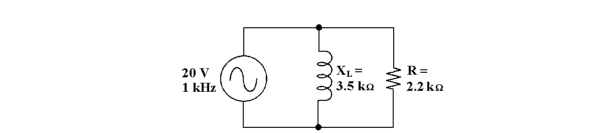

-If the resistor decreases in Figure 12 -2, the total current _ _.

Definitions:

Taxable Income

Taxable income is the amount of income used to calculate how much tax an individual or a company owes to the government in a given tax year.

Pretax Financial Income

Income of a company calculated before taxes are deducted, often compared to taxable income for tax planning.

Deferred Tax Asset

A tax benefit that arises from temporary differences between the tax and accounting treatment of assets and liabilities, to be utilized in future periods.

Income Taxes Payable

This account reflects the amount of income taxes a company owes to the government but has not yet paid, representing a liability on the balance sheet.

Q1: How much voltage does the resistor drop

Q4: Performance appraisals may be conducted by .<br>A)peers<br>B)subordinates<br>C)the

Q10: If an inductor, resistor and switch are

Q16: If RC and RL differentiators with equal

Q17: What is output voltage at the end

Q29: All of the following are advanced types

Q32: If the frequency increases in Figure 12

Q48: Any attempt to improve managerial performance by

Q59: The phasor combination of VR and VC

Q62: Identify the Normally Open Push Button switch