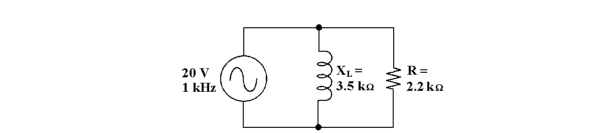

-If the resistance increased to 10 kΩ in Figure 12 -2, the total impedance is .

Definitions:

Strike Price

The fixed price at which the owner of an option can purchase (in the case of a call option) or sell (in the case of a put option) the underlying security or commodity.

Risk-Free Rate

The rate of return on an investment with zero risk, typically associated with government bonds, serving as a baseline for evaluating investment risk.

Put Option

A financial contract giving the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified time.

Exercise Value

The value of an option if it were exercised at the current time; essentially the difference between the strike price and the current price of the underlying asset.

Q1: With , a trainer in a central

Q7: If the voltage is suddenly switched off

Q9: If 6.8 kΩ, 1.2 kΩ and 5.6

Q12: Which of the following goals is the

Q26: To couple two circuits together with no

Q34: Trainers often try to solve employee performance

Q43: The most popular technique for appraising performance

Q48: If a 10 kΩ and 5 kΩ

Q55: The output from an RL differentiator is

Q107: John, the supervisor of the manufacturing department,