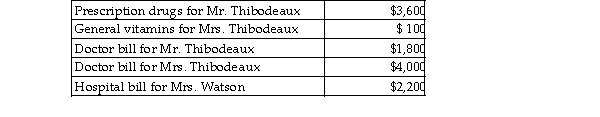

Mr. and Mrs. Thibodeaux (both age 35) , who are filing a joint return, have adjusted gross income of $100,000 in 2018. During the tax year, they paid the following medical expenses for themselves and for Mrs. Thibodeaux's mother, Mrs. Watson (age 63) . Mrs. Watson provided over one- half of her own support.  Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Definitions:

Suicidality

The risk of suicide or a tendency towards suicidal behavior.

Refugee

A person forced to flee their country due to persecution, war, or violence.

Foreign Born

Individuals who were born outside of the country they currently reside in, regardless of their current citizenship or nationality.

Native-born Classmates

Individuals born in the country they currently reside in, as referenced in the context of an educational setting alongside others who may be immigrants or international students.

Q11: A coherent set of ideas that helps

Q18: A taxpayer may avoid tax on income

Q24: The elementary school years where children need

Q128: Dr. Wong is a cognitive developmental theorist,

Q151: A _ is a group of people

Q316: The destruction of a capital asset due

Q357: Benedict serves in the U.S. Congress. In

Q639: Which statement is correct regarding SIMPLE retirement

Q791: Hui pays self- employment tax on her

Q2200: For purposes of applying the passive loss