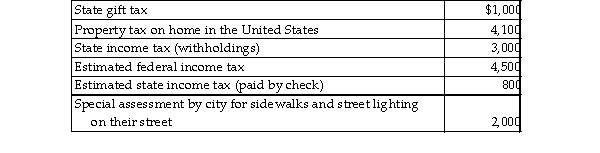

During the year Jason and Kristi, cash- basis taxpayers, paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in current year?

Definitions:

Consideration

Something of value exchanged between parties in a contract that induces them to enter into the agreement.

Bargained-For Exchange

An exchange of promises or performance by parties to a contract that provides the consideration necessary to make the contract legally enforceable.

Breach of Contract

The violation of any term or condition of a binding legal agreement, which may result in legal action for remedy.

Illusory Promise

A statement that appears to commit to an action but does not actually bind the party to any obligation.

Q8: Compared with earlier decades, U.S. adults are

Q122: A child who has just begun to

Q201: Jessica spends a lot of time thinking

Q309: Bad debt losses from nonbusiness debts are

Q383: Which of the following statements regarding Coverdell

Q1118: Richard is a key employee of Winn

Q1262: An individual is considered terminally ill for

Q1355: A net operating loss (NOL) occurs when

Q1468: If Houston Printing Co. purchases a new

Q2135: All of the following items are excluded